China has announced retaliatory tariffs on Canadian agriculture products after Canada imposed a 100% tax on Chinese electric vehicles, and a 25% duty on steel and aluminum. China’s tariff announcement covers $2.6 billion worth of Canadian agricultural and food products and are scheduled to take effect on March 20th. China will apply a 100% tariff to just over $1 billion of Canadian rapeseed oil, oil cakes, and pea imports. Meanwhile, a 25% duty will be placed on $1.6 billion worth of Canadian seafood products and pork.

According to Chinese customs data, China is Canada’s second-largest trading partner, trailing behind the United States. This latest development in the trade war comes after the United States and Canada launched an anti-dumping investigation into Chinese pea protein concentrate imports in 2023. By August of 2024, the US Department of Commerce determined that four Chinese manufacturers would face countervailing duties of 355%. Producers that are under government control would receive anti-dumping duties of almost 270%. Canada followed suit with the US investigation and made similar determinations regarding countervailing duties in November 2024.

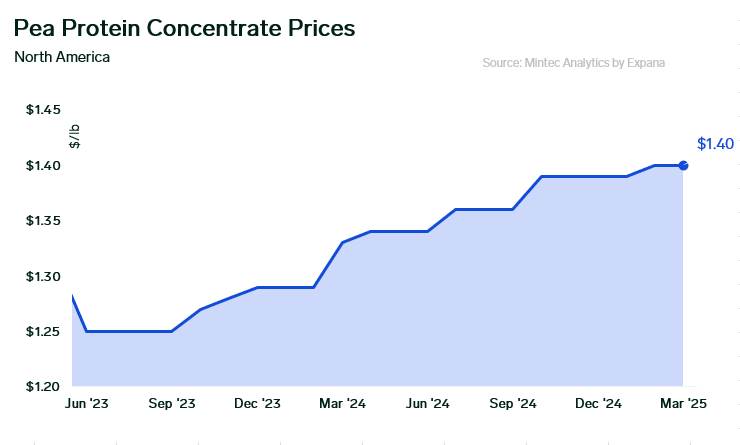

The anti-dumping duties were put in place after pushback from domestic producers to create a fairer market with balanced competition. As a result, industry players have considered alternative sourcing options as the tariffs to import pea protein concentrate are significant. The Expana Benchmark Price pea protein concentrate in North America was most recently assessed at $1.40/lb, up 5% y-o-y. According to market participants, there is still surplus supply in storage being absorbed by the market, but players expect the market to turn more bullish in the months ahead as stored product starts to dwindle and the tariff situation remains uncertain.

Authored by:

Andraia Torsiello

Expana