China new government stimulus: metals markets react with rapid growth

In September 2024, the Chinese government announced sweeping economic stimulus measures aimed at supporting domestic demand and growth in the Chinese economy. These measures have already started to take effect from the end of September and will continue to be implemented throughout autumn 2024.

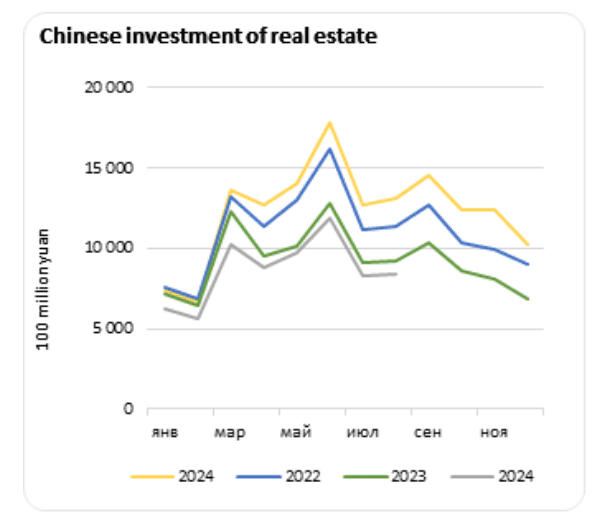

First, the Chinese government has lowered the interest rate on mortgage lending, as well as reduced the share of the down payment on mortgages. Specifically, the mortgage rate for young people under 35 years old has been reduced to 3.4%, 0.6% lower than the standard rate, from October 1, 2024. For workers living in rural areas, the rate has been reduced to 2.9%. In addition, there are also tax incentives for families with children. In this way, China plans to restore consumer demand in the construction industry, which has been performing poorly over the past three years.

Source: National Bureau of Statistics of China

In addition, the government stimulus will also affect industries that were already developing dynamically. For example, subsidies for the purchase of cars and household appliances were introduced to stimulate consumer demand. In addition, large-scale investments in infrastructure were announced, including transport logistics development and investments in the construction of solar and wind power plants.

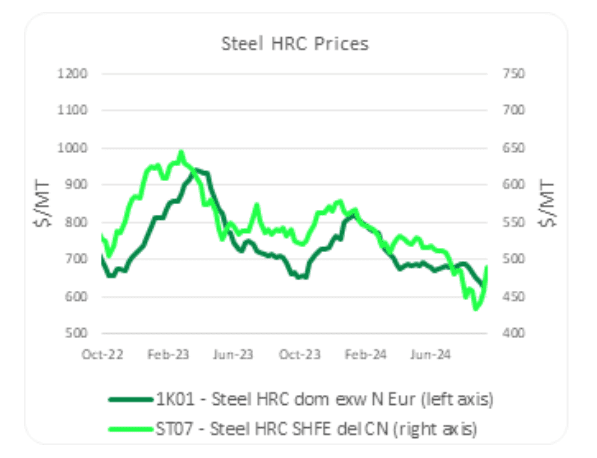

The introduction of new stimulus measures caused a positive reaction on the financial markets. China’s Shanghai Composite stock index rose 13% in the two weeks following the announcement of the stimulus package. The most noticeable was the impact of these measures on commodity markets, primarily on metal prices, which are the basis for the Chinese construction industry. Rising expectations that the stimulus measures will lead to a significant increase in demand for raw materials caused metals prices to rise globally since the last week of September.

Source: Mintec by Expana Analytics

The LME copper price, which is an important indicator of the development of the industrial sector of the economy, rose 6% in the two weeks after the measures were announced. Steel futures on the Shanghai Metal Exchange rose 15%. Aluminum prices on the LME rose 8%, due to growing demand for the product in the automotive and construction industries. Prices also benefited from the government’s plans to support environmentally friendly technologies.

Rising metals prices reflect the high level of expectations of demand growth in China. However, in the longer term, despite the short-term optimism, uncertainties remain, and much will depend on China’s ability to cope with domestic economic challenges.

Escalating Middle East tensions send energy prices higher

Last week, crude oil prices moved markedly higher. For the week ending October 4, the Brent crude oil price soared nearly 8.5%. The main driver was the significant ongoing escalation in the conflict in the Middle East. In recent days, Israeli forces have stepped up strikes on Hezbollah in Lebanon and Hamas in Gaza, resulting in many casualties. Some Israeli troops have also been involved in ground offensives into Lebanese territory.

The action resulted in Iran launching missiles against Israel. Although there has been no subsequent action directly by the Iranian state, market players expect a missile response from Israel in retaliation against Iran. Sources have long been concerned about the impact of a wider regional conflict on energy markets, considering the concentration of oil production in the area. In the last few days, market sources have expressed worry at the prospect of Israeli missile strikes on economic infrastructure in Iran. The main concern within energy markets is the prospect of attacks on oil facilities and refineries, which players believe would add further upward price pressure to energy prices.

Gas prices in Europe also rose in the week ending October 4 due to the prospect of a bigger, protracted conflict in the Middle East. Gas market players in Europe are concerned about supply disruption, especially if Iran and Israel trade further missile strikes over a prolonged period.

Following price surges in recent weeks over concerns about the impact of Hurricane Helene, natural gas prices in the US eased slightly in the week ending October 4. However, weekly stock levels have been narrowing compared to the 5-year average, with sources anticipating tighter stocks during the winter, due to heightened seasonal demand.

Want to dig into further insights? Discover more on our insights page.

Written by Nick Wood