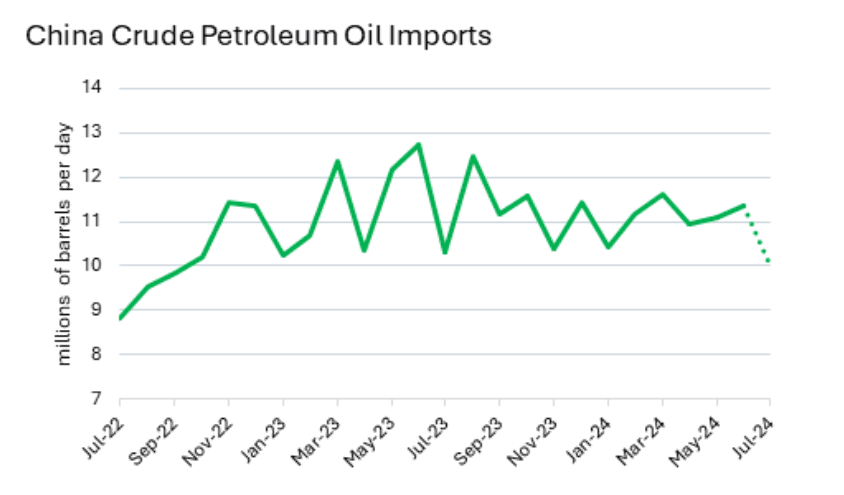

China’s crude oil imports fall sharply amid a contraction in manufacturing

According to provisional data from the General Administration of Customs of China, and Expana calculations, China (the world’s top crude oil importer) imported an average of 10.01m barrels per day (bpd) in July. The July figure marks a significant decline from the previous month, when the country imported an average of 11.35m bpd, representing an 11.8% month-on-month (m-o-m) decrease. The July figure is also down 3.1% on an annualized basis. As the chart below shows, the July import figure fell below the recent lows of around 10.3m bpd and is the lowest figure since September 2022.

Source: General Administration of Customs of China, Expana calculations

The sharp monthly fall in crude oil imports by China can be attributed to a manufacturing slump in the country. In July, the Caixin purchasing managers’ index (PMI) decreased to 49.8, entering contraction territory below the 50 level. The PMI in China had been relatively robust in recent months, compared to the US and the Eurozone, maintaining growth since October 2023. However, the notable drop in July concerned market players who suspect that the contraction in manufacturing could be the beginning of a trend of lower oil demand from China.

Over the last several days, the crude oil price has been rocked by tensions in the Middle East, specifically following Israeli attacks on targets in Beirut, Lebanon, and Tehran, Iran. Sources are therefore concerned that oil supply may be impacted from the Middle East in the event of a serious escalation or a protracted regional conflict, adding bullish sentiment to the market. However, following a weak non-farm payroll number in the US, there was widespread concern among market players about a recession, which they believe could result in marked lower demand for crude oil.

Although China’s import dynamics are not the sole factor driving the market, the monthly figures are being closely followed by market players as a demand gauge. For reference, the weekly Brent crude oil price (DH-0) was $77.59/barrel on August 7, down 9.7% m-o-m, representing a 9.9% y-o-y decline. Expana will provide further updates as more information becomes available.

Ocean freight rates declined during the first week of August

The global shipping 40ft container composite index rose 17% m-o-m to $5,850 per unit in July. However, for the first time since April 2024, a weekly price decline was recorded in the last two weeks of July, which continued in August. On August 7, the global shipping 40ft container composite index was $5,550 per unit, down 3% w–o-w and 6% m-o-m. This was mainly related to changes in supply and demand and other macroeconomic factors.

In H1 2024, demand for transport services was high, as companies were actively replenishing inventories and preparing for the holiday season. However, in July, many companies completed major purchases, which led to a decline in demand for transport. The sharp fall in global stock markets in early August caused concern among traders and companies. Amid economic uncertainty, many companies became more cautious in their purchases and preferred to reduce the volume of goods transported to avoid the risk of accumulating surpluses, anticipating a possible decline in consumer demand. Some importers, particularly in Europe and North America, have begun to favor local suppliers to reduce freight costs.

Despite the persistent shortage of vessels, which was one of the reasons for the rise in freight costs, improvements in logistics chains were observed in several regions by the end of July. Some routes, especially in Asia, became less congested, resulting in reduced pressure on prices. In early August, there was an increase in the number of empty containers returning to ports of departure. This was due to the end of the active export season in some regions, which led to lower vessel utilization on return routes. Consequently, ship owners started to reduce freight rates to minimize losses from shipments with empty containers.

The ocean freight market in July and early August 2024 showed that the strong demand observed in H1 2024 is gradually waning. Against the backdrop of economic uncertainty and changes in shipping patterns, companies began to adjust their procurement and logistics strategies, which had an immediate impact on shipping costs. Overall, the decline in ocean freight costs in early August indicates that the market may be entering a correction phase if negative economic trends persist. This requires companies to be flexible in managing their supply chains and closely monitor the market situation to make timely decisions.

Want to dig into further insights? Discover more on our insights page.