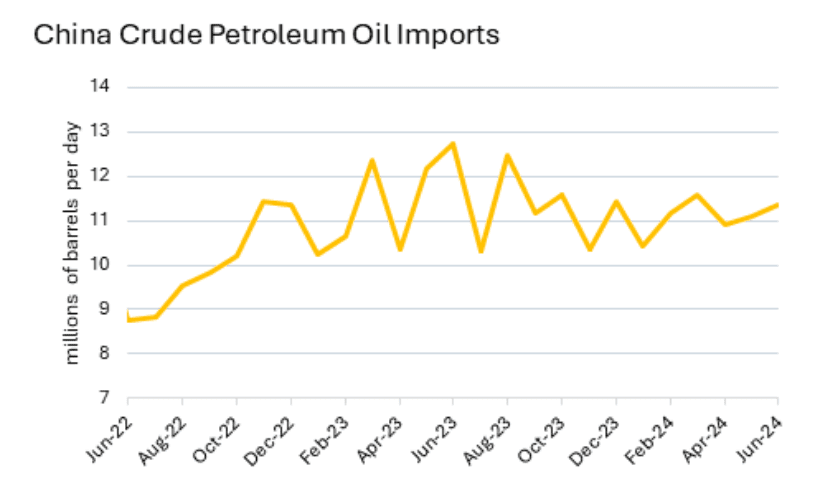

The Brent crude price drops despite increasing imports by China

According to preliminary data from the General Administration of Customs of China and Expana calculations, China (the world’s largest importer of crude oil) imported an average of 11.35m barrels per day (bpd) of crude petroleum oil in June. The June figure was a 2.2% month-on-month (m-o-m) increase compared to the average of 11.11m bpd in May. However, on an annualized basis, the June number marked a 10.8% decline. As shown by the chart below, monthly crude oil imports by China have largely stabilized and have not fallen beneath the 10m bpd mark since September 2022. June’s preliminary results represent the third consecutive month of increasing imports.

Sources: General Administration of Customs, Expana calculations

Much of the strength in crude oil imports by China can be traced back to robust manufacturing activity in the country, with the Caixin Purchasing Managers’ Index (PMI) registering 51.8 in June. The PMI has been above 50, and therefore in expansion territory, for eight consecutive months. Last month, market sources stated that input costs were becoming more of a challenge for producers, specifically energy costs. However, orders remain strong, adding support to overall manufacturing activity within China’s economy. To that end, market players believe that demand for crude oil from China will continue to trend upwards, potentially adding a bullish undertone to prices.

The broader crude oil market continues to be defined by elevated US production and geopolitical uncertainty in the Middle East. In the US, crude oil production averaged 12.9m bpd in 2023, a record high, which has been driving prices down in recent months. However, market participants had been concerned about supply shortages due to disruption to Middle East production caused by the Israel-Palestine conflict. Currently, though, the conflict appears to be contained. For reference, the Brent crude oil price (DH-0) was $82.57/barrel for the week ending July 24, down 3.4% m-o-m, representing a 0.7% year-on-year (y-o-y) increase.

Expana will provide further updates as more information becomes available.

July trade highlights from China, the US and the EU

China

China’s trade balance for May 2024 was $82.6 billion, representing a year-on-year (y-o-y) growth of 28%. The rise consisted of a 7.2% y-o-y increase in exports and a 0.9% y-o-y climb in imports. Chinese monthly imports have reportedly been stable since March 2024, hovering around $220 billion, while exports have been increasing since February 2024, reaching $302 billion in May.

China’s Ministry of Commerce issued statements this month to provide further detail on the anti-dumping investigation into EU pork. The Ministry will be using a sampling method in the anti-dumping probe, targeting countries in the EU that are reportedly supportive of EV tariffs against China. If action is taken after the conclusion of the investigation, this would worsen an ongoing trend of a declining share of China’s EU pork imports. The EU represented 63% of China’s pork imports in 2019, down to 51% in 2023.

China’s pork imports peaked in 2020 at the height of the African swine fever (ASF) outbreak, with imported pork accounting for 13% of Chinese domestic consumption. As of 2024, the USDA projects that pork imports will account for only 3% of consumption. The recovery and improvement of pork production in China lowered demand for imported pork, with the US and Brazil occupying greater import share in China, lessening the significance of EU pork imports. The Chinese market for pork is projected by the USDA to decline in 2024, with consumption falling to 58.2 million mt, representing a 2.6% y-o-y drop in demand.

The EU reports that from January to May 2024 pork exports decreased by 445,000 tonnes compared to the same period in 2023. 180,000 tonnes of the total decrease is attributed to China, representing a 29% decrease y-o-y for the January-May period. The factors indicate that China could suffer fewer consequences from trade restrictions on the EU pork market than the consequences for the EU. While alternative international markets, such as Japan and South Korea, could make up for a portion of the lost demand from China, this will only partially offset the loss.

US

The US foreign trade deficit for April 2024 was $107 billion. Monthly imports grew 8% y-o-y and exports increased 5.6% y-o-y, resulting in a trade deficit growth of 12%, which is the highest trade deficit since October 2022.

With the recent withdrawal of President Joe Biden as the Democratic Party nominee, which sources report strengthened former President Donald Trump’s chances of victory, there are greater expectations of trade war policies coming to fruition from a Trump presidency. The reaction from investors on July 17 caused global chip stocks to fall with drops ranging from 10% to 2.4%. While the presidential race remains uncertain, it is clear that the market expects larger trade disruption under a Trump presidency, potentially hindering trade growth in 2025.

In July 2024, the US continues to face pushback to the chip restriction on China. However, during talks between the US, Japan and the Netherlands, the US mentioned potentially implementing harsher trade restrictions. A measure called the foreign direct product rule (FDPR) states that any product made using American technology (semiconductors) can be prevented from being sold by foreign countries. The US pushing for its allies to tighten measures to prevent China’s access to advanced semiconductor technology.

EU

The latest figures for March 2024 show a 4.2% m-o-m increase in EU exports and a 4.4% m-o-m rise in EU imports. These figures represent a 0.1% decline in the EU trade balance, to $35.9 billion.

The Eurostat report on international trade in goods estimates positive growth in monthly trade for April 2024 compared to April 2023, with expectations of a 13.5% y-o-y increase. Initial estimates for May, as shown in the July report, show a 0.5% y-o-y decrease in monthly exports amounting to a €13.9bn surplus in May 2024, potentially representing a slight decrease from the €14.2bn surplus estimated for April, due to a decline in surplus trade of machinery, vehicles and chemicals. Furthermore, while the y-o-y estimated change in exports for May is small, there are significant shifts in trade partners, with the EU exporting more to the US, Norway and Brazil, and less to China, Switzerland and South Korea.

The January-May 2024 surplus is estimated to total €84.9 billion, a significant increase from the January-May 2023 deficit of €21 billion, showcasing the significant recovery from 2023. In July, the EU made changes to tariffs regarding Russia and China. On July 22, the EU Council decided to renew restrictive trade measures for another six months, until January 31, 2025, inclusive of the new 14th package of sanctions implemented on 24th June. This package targeted energy, finance and trade.

A report on July 4 showed that after intense consultations with the Chinese government, companies that cooperated with the investigation received a 20.8% weighted average duty, while non-cooperating companies received 37.6%. These rates are adjusted slightly downwards from the initially disclosed June rates. The provisional rate will be in effect for four months starting from July 5, 2024, where within that time frame a final decision of the duties will be voted on to then be definitive for a five years.

Want to dig into further insights? Discover more on our insights page.