The global economy today shows some parallels to past pre-recession periods.

A world PMI below 50, elevated asset prices, for instance, are indicators of a slowdown in business activity.

Furthermore, rising tariffs, protectionist policies, or geopolitical disruptions could exacerbate trade slowdowns. Consumer spending is also paramount since it accounts for a significant portion of GDP. Monitoring retail sales, credit card usage, and savings rates will be critical.

With the global economy facing a myriad of challenges and uncertainties, the likelihood of a recession in 2025 is a topic of significant debate among economists and policymakers. None of which agree as far as predicting exactly when it will happen.

Expana experts, however, forecast that a global recession will very likely start in spring 2025.

“All our models point to this as a very likely outcome,” says Tom Bundgaard – VP Forecasting – Expana.

The recession could be quite deep and longer than usual recessions, predicts Bundgaard. “That is not a very positive outlook, and we don’t like it either.”

“Most analysts do not agree with our view and talk about a ‘soft landing’ instead. The soft landing may be entirely possible, but that is not our take on the situation,” Bundgaard added.

Expana argues that one of the biggest casualties of a global recession could be the food supply chain.

The impact of such a recession could be lower commodity prices, with agricultural and food businesses feeling increased and sustained pressures to carefully time their buying, selling, or hedging. “Lower commodity prices will always be the outcome of a recession, but it comes with a time lag. This means that spring 2025 will still experience some price increases that can be hedged shortly, and this bullish reaction is dependent on the fundamentals of each individual commodity. However, shortly after a recession is confirmed, all commodity prices act like a school of fish and start to decline in tandem. For that reason, all hedging should be quite short in spring 2025 for most commodities,” he says.

“We need to warn about this – even if it isn’t confirmed by signals yet,” Bundgaard claims. “The highest odds point to a hard landing and not a soft one, so buckle up and prepare for that possibility. If this turns into a hard landing, we will share the signals before it unfolds.” Bundgaard adds: “Stay tuned and be prepared for contingency plans. The recession will undoubtedly impact commodity prices.”

Bundgaard expects the following four factors to contribute towards a global macroeconomic recession next year:

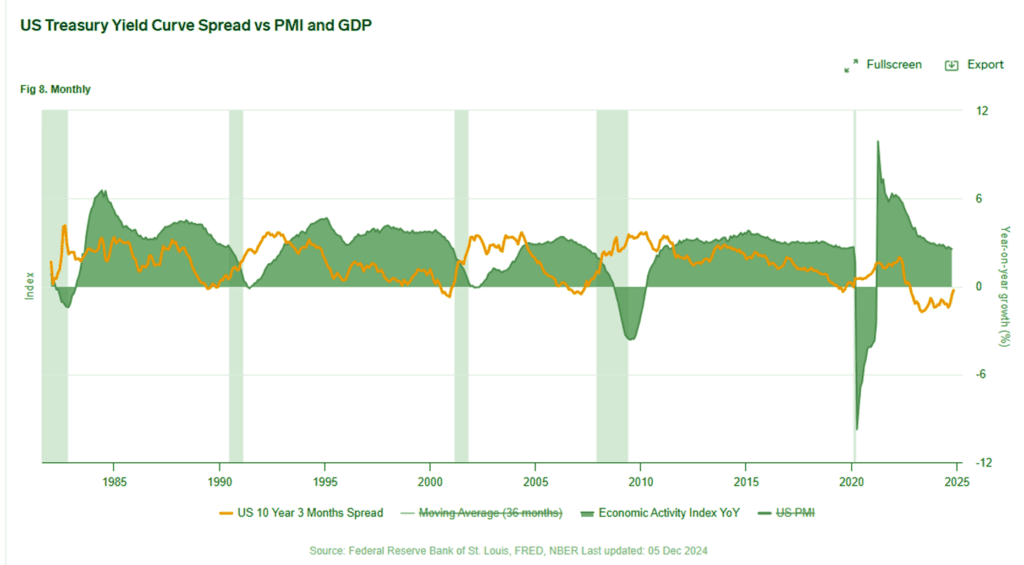

Factor 1: In the US, the treasury yield curve has been inverted for quite a while and is now about to come out of inversion.

“That has proven to be one of the most reliable indicators of a coming recession,” Bundgaard argues. “It has proven its worth over the past century and almost without error. Nothing is ever 100% certain, but this ranks high on the list of indicators pointing to a coming recession in 2025.”

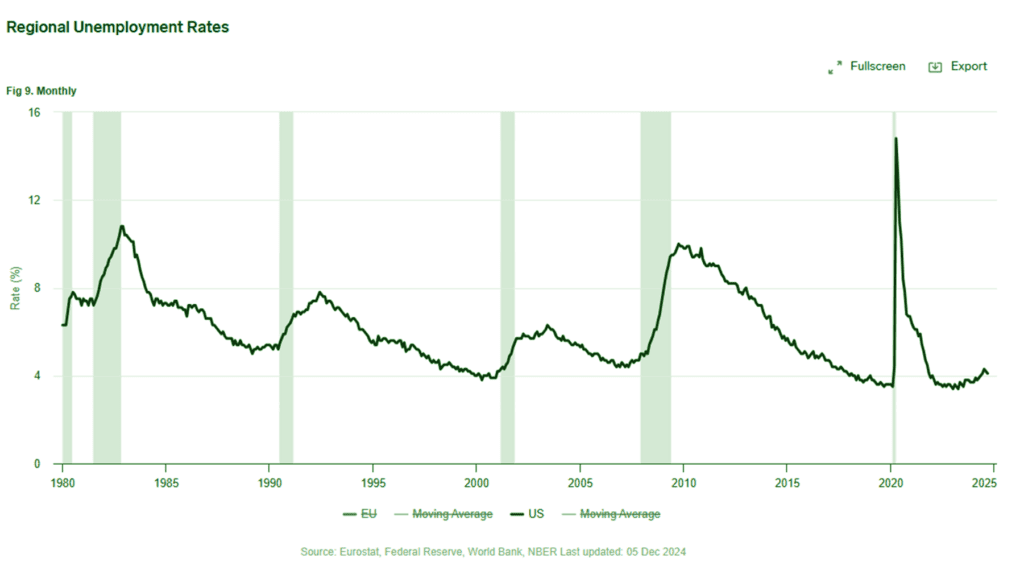

Factor 2: Unemployment in the US started to increase in the summer of 2023 and has continued to rise since, from roughly 3.5% to 4.30%.

“Whenever the unemployment curve starts to rise it typically continues, and shortly after such a rise, we typically see a recession forming. The timing for that is already overdue compared to similar historical situations, so it could happen at any time,” Bundgaard comments.

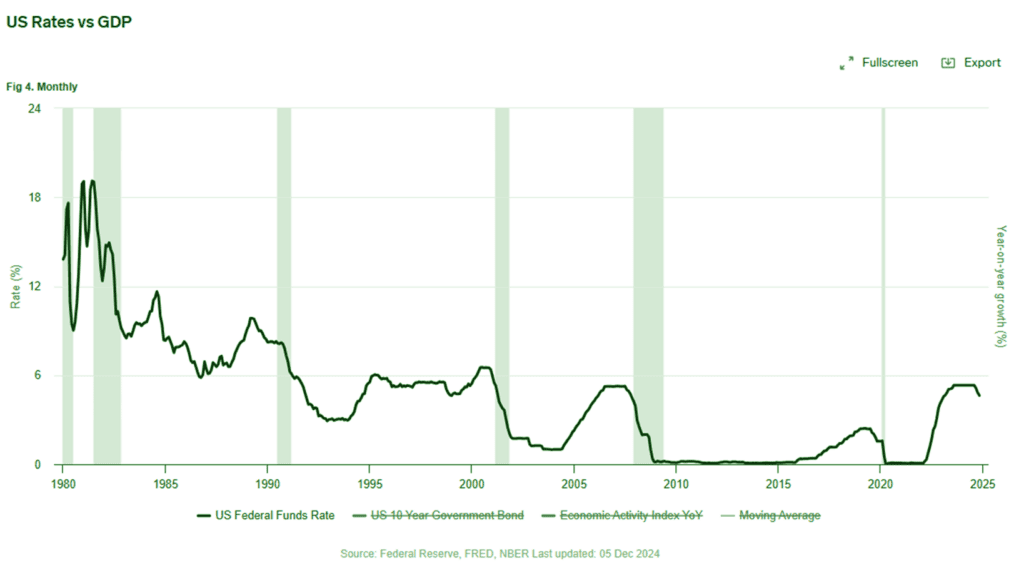

Factor 3: The Fed interest rates were lowered this year, in line with expectations, from about 5.3% to 4.3%.

“When interest rates start to fall, we very often see a recession happen shortly afterwards. This, added to unemployment and the inverted treasury yield curve shows a worrying set of indicators that all point to the same outcome,” Expana’s VP Forecasting highlights.

Factor 4: Sideways economic movement

Strangely enough, Expana’s technical analysis is the only thing that is not confirming a recession yet. The technical analysis has for some time confirmed that the economy is in a sideways movement, wobbling between not being able to show increasing growth, but also not succumbing to a recession.

“Since 2021 we have pointed to three phases in the economy, ending in a recession in 2025. The current sideways movement is the second phase, and we had forecasted this to last until the end of 2024. We can define this as a sideways motion in the World PMI between 48.6 to 51. We should, however, be close to the end of this sideways movement,” Bundgaard says. “This should then give way to phase three, which is the recession at some point in spring 2025. We have definite points where the fundamental and technical analysis will confirm a recession (or a renewed growth), but we have to contend with a sideways trend right now. Most of the fundamentals do, however, point to a likely recession starting in spring 2025, and that would be our most likely bid.”

Expana experts have naturally looked at different scenarios.

“There is scope for things to go differently than expected. In that case, we would argue that the sideways trend could continue in 2025. Depending on how you measure things, the economy has been in a sideways trend for a few years (falling growth rates but no recession), and it would not be unthinkable that the economy could continue like this for another year, just keeping the status quo. That is possible, especially given how the stock market has been positive since the US election,” Bundgaard explains, adding that the odds seem to be more in favor of the previously outlined negative outcome.

Expana continues to work very closely with clients, discussing where prices will likely go, and how to apply hedging or plan for effects on volumes, etc.

“The last time we did that, we got ridiculed in the papers, but we were proven right within a few months. However, just because we got our last predictions right doesn’t mean we will get this one right, so let us monitor the situation and prepare,” Expana’s VP Forecasting comments.

“We expect to get ridiculed again this time, as few analysts expect a recession. And it will certainly take quite some months before we can see whether we are correct or not about the timing of spring 2025, either Q1 or Q2,” he confesses.

However, if the hard landing materializes, Bundgaard does not expect any applause because no one will benefit from a hard landing.

Authored by: Tom Bundgaard, VP Forecasting & Simon Duke, Managing Editor – EMEA, Expana

Media Inquiries: [email protected]