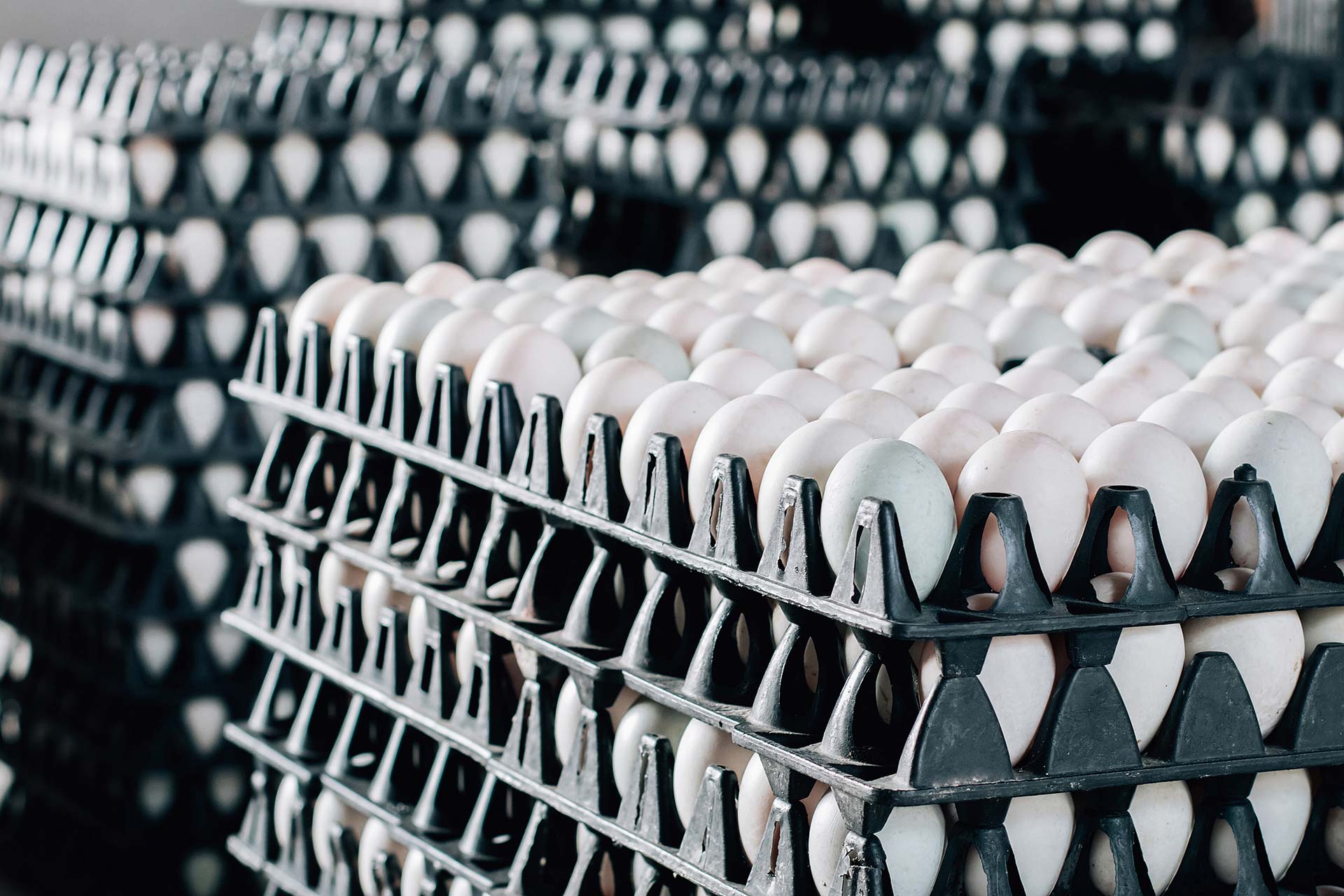

Overview

In the latest Egg Market News, U.S. California wholesale egg buying interest remains brisk, yet not as aggressive as in recent weeks. Suppliers report slight shifts in purchasing behaviors, with some now having limited flexibility—an uncommon scenario until now. While certain pack requirements may still be challenging to meet, others appear more attainable. Notably, runtime constraints persist due to bird flu regulations that prevent immediate restart of certain farms until they pass inspections. This limitation on regraded eggs continues to influence pricing and inventory dynamics.

Supply and Demand Dynamics

Larger egg sizes remain short on the West Coast, while slightly improved availability is noted in Eastern markets. Medium-sized eggs are nearly as tight, with some supply now redirected from further processing channels. Buyers who previously paid well above quoted values now find loose trading at slightly lower levels, a significant market shift. Overall, the market remains firm, with wholesale egg prices still trading at premium levels, albeit not as steep as before.

Retail and Institutional Trends

Retail demand, as reported in this Egg Market News update, ranges from fairly good to good. As the holiday approaches, warehouse deliveries are wrapping up, giving way to increased store-level orders. Price disparities remain substantial—some accounts reportedly differ by more than $3.00. Naturally, lower-priced retailers are capturing more business, leveraging eggs as a loss leader to boost foot traffic and incentivize broader consumer purchasing.

Institutional and foodservice sectors show stable interest, though buyers are cautious and not eager to overstock. Canadian demand for U.S. shell eggs also persists, with sources suggesting their needs outstrip current availability.

Inventory and Stock Reports

The USDA’s recent inventory report provides critical insights for Egg Market News followers:

- Shell Egg Stocks: Down 3% this week at 1.212 million cases. This figure is 11.9% lower than the same period last year and sits 15.0% below the five-year average.

- Breaking Stock Supplies: A modest 0.3% decline to 304,500 cases. Year-over-year, breaking stock lags by 17% and trails the five-year average by 5.1%.

- Total Stocks: Now at 1.517 million cases, down 2.5% from last week and 13.0% from the same week last year.

- Cage-Free and Specialty Supplies: Notably, these are the only categories to show an uptick, rising by 5.0% and 27.5% respectively.

Outlook

This week’s Egg Market News indicates a firm yet evolving environment. As holidays draw near, inventory management, pricing strategies, and supply chain constraints (including bird flu-related downtime) will continue to shape market conditions. Stakeholders will watch closely for shifts in buying interest, holiday demand patterns, and how pricing disparities influence consumer preferences.

Stay tuned for more Egg Market News and insights into U.S. egg supply, pricing, and demand trends as the holiday season unfolds.