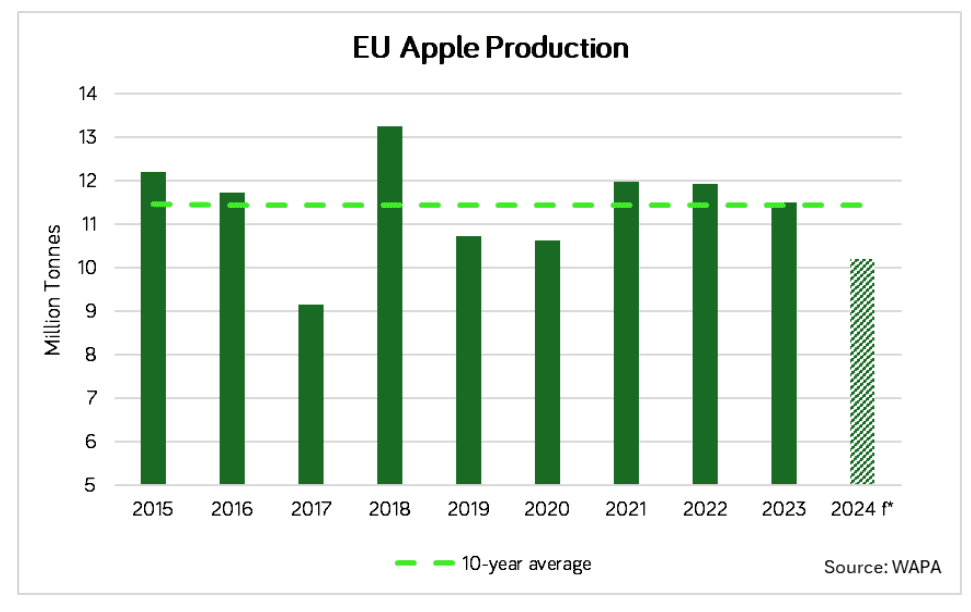

WAPA confirms concerns over small European apple harvest

On Aug. 8, the World Apple and Pear Association (WAPA) released its production forecast for the 2024/25 market year for apples and pears. European apple production is expected to decrease by 11.3% year-over-year (y-o-y) to 10.2 million tonnes, falling short of the initial expectations of around 11 million tonnes, as reported by market players to Expana.

Poland, Europe’s largest apple producer, is forecast to account for 31% of all apples in Europe in 2024. The country, which also has the largest apple juice processing capacity in Europe, will see its production drop by 19.6% y-o-y, 25% lower than the three-year average (2021-2023). This decline follows an unusually warm period in late March and early April, where temperatures regularly exceeded 20°C, prompting fruit trees to bud prematurely. In the following weeks, temperatures plummeted below freezing at night, damaging the buds and ultimately reducing yields.

The report highlights changes at the varietal level, noting that Golden Delicious production is set to shrink by 10.2% to a total of 1,97 million tonnes. Gala, the second-largest variety, is expected to decrease by 11.1% to 1.35 million tonnes. Idared production is projected to be 18.4% lower than in 2023 at 0.5 million tonnes. Conversely, Red Delicious is estimated to see a production increase of 2.8% to 0.61 tonnes.

The reduced availability of apples is expected to impact the fresh consumption markets, although supplies from Western Europe are likely to remain steady throughout the season. Market players anticipate that the processing industry will be more severely affected, as key processing regions like Poland have been hardest hit. Increased competition for the lower stocks between the fresh consumption and processing markets is expected to exacerbate the situation. Market players estimate that apple juice concentrate production in Poland, based on the forecast, will be around 200,000 tonnes. One industry source told Expana, “The year ahead will be a tricky market, characterized by tight supplies and high prices.” The Expana Benchmark price for medium-acidity apple juice concentrate is currently as of (31/07) up 45% y-o-y at €2250/mt.

2023/24 almond shipments are the second highest on record

US almond shipments ended the 2023/24 season at 2.69 billion pounds, a 5% increase from the previous year, and the second-highest shipment figure on record.

The Almond Board of California’s published ending stocks estimate of 505 million pounds is expected to be revised downwards in the first position report published for the 2024/25 season. The current estimate is based on a standard pre-season figure of 2% loss and exempt. When accounting for the increased levels of rejects this year (4%), this would place ending stocks around 450 million pounds.

While season-to-date figures remain strong, the July position report released on Aug. 9, broke the streak of shipments above 200 million pounds, which were seen in the rest of the 2023/24 season. Shipments for July 2024 were reported by the Almond Board of California at 179 million pounds, a drop of 4% year-on-year and marginally below the bottom of industry expectations.

Before the release of the position report, market participants surveyed by Expana expected shipments of 180-215 million pounds, with most respondents returning figures of 190-205 million pounds.

“While the figures aren’t much lower than expectations, they could grab on prices slightly as the headline ending stocks figure is higher than expected. We’ll have to see what happens over the next few weeks. I’m not expecting much trading activity anyway as everyone is focused on harvest,” a US trader disclosed to Expana.

For the latest in nuts, fruits and vegetables, please watch our recent webinar recording.