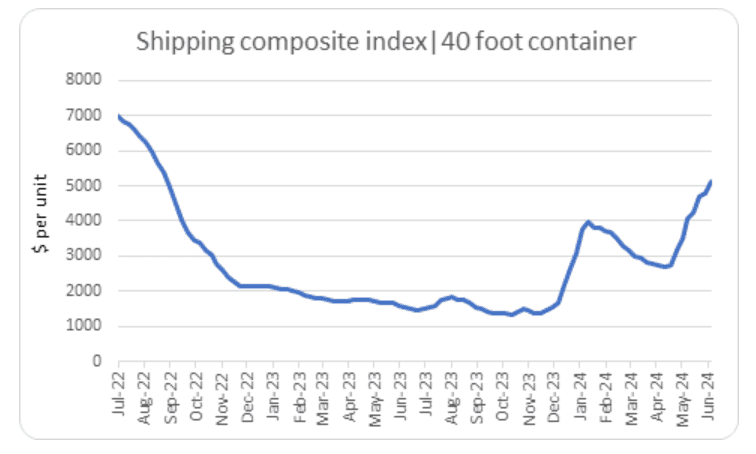

Source: Expana

Strong demand for ocean freight continues to support the bullish trend in the market, causing freight rates to rise. The shipping composite index of 40-foot containers reached $5,117/unit at the end of June, against $4,700/unit in early June 2024. Thus the index rose by 7% week-on-week (w-o-w), 26% month-on-month (m-o-m), and 233% year-on-year (y-o-y). In the third week of June, the most dynamic growth of freight rates for container transportation on the route China – Northern Europe +11% w-o-w, against the background of continuing problems with navigation in the Red Sea. The catalyst for price growth continues to be robust demand for transport.

Seasonal demand growth, which usually occurs in Q3, started earlier this year. Seeing the potential for rising ocean freight costs and supply disruptions, shipping orders have started to arrive earlier to avoid peak prices. As a result, market sources expect shipments to peak in July-August.

To meet demand, carriers are launching new vessels for trans-Pacific and Asia-Europe voyages. In addition, smaller regional carriers are also entering the trans-Pacific for the first time since the COVID-19 pandemic. Thereby diverting vessels from regional routes, which is likely to lead to an increase in ocean freight prices on regional routes. Hence, this is likely to balance the shipping market in the coming months.

In some ports in Germany and France, strikes took place in July, significantly worsening the process of unloading and loading of containers and their further transshipment on railway transport. The strikers are demanding wage increases due to the rising cost of living. In addition, the change in logistics in the Red Sea has led to overloading in Asian ports. In particular, Singapore’s ports have seen a significant increase in demand for transshipment of cargo, and the ports have also received an unpredictable influx of ships returning to Asia bypassing the African continent. As a result, vessel delays totaled about seven days, which certainly worsened the situation with the availability of vessels for chartering. Thus, the problems faced by carriers in the ports worsen the capacity shortage and further encourage freight rates to rise.