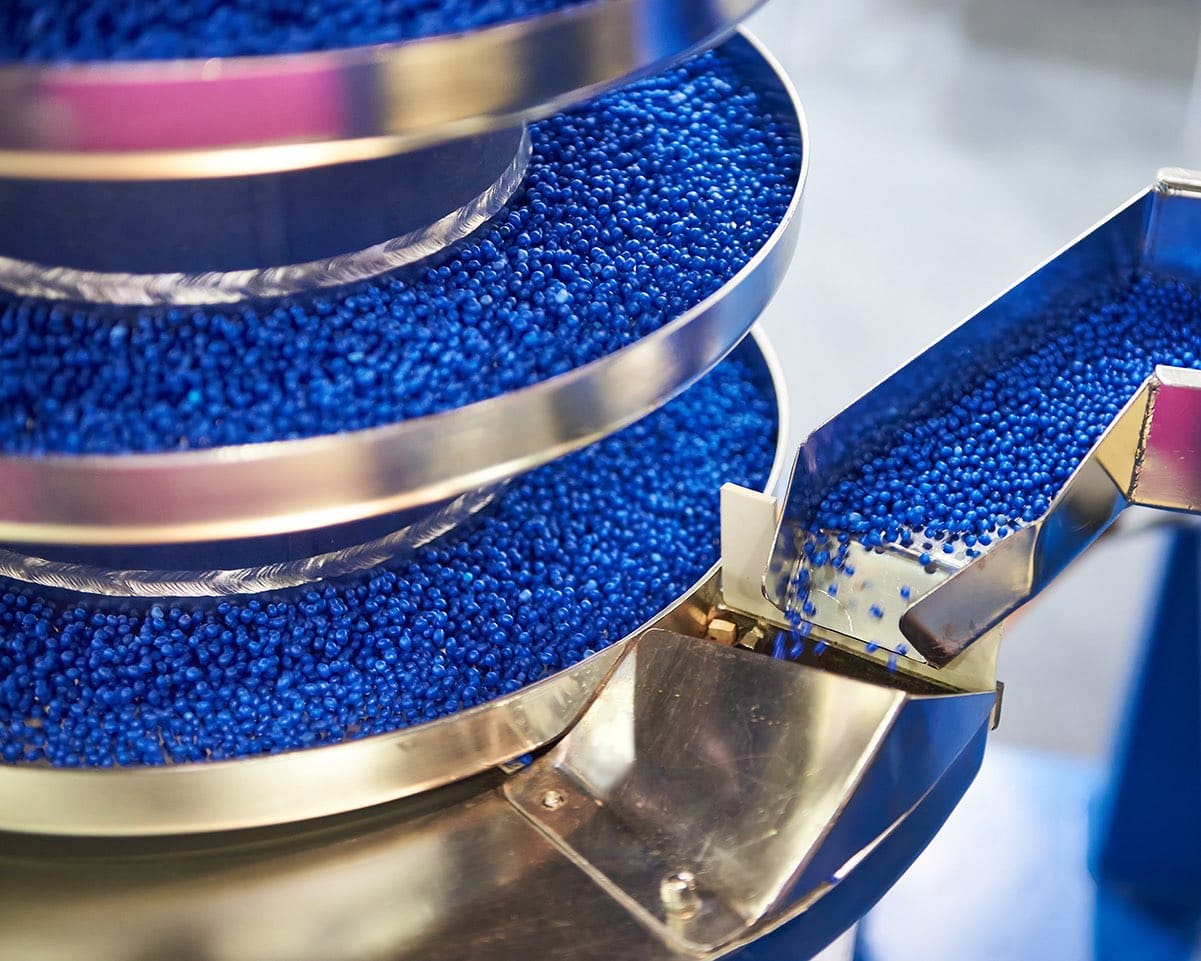

Weak demand and reduced output continue to impact global plastics markets

For several months, Mintec has reported weak demand across all plastics segments, adding bearish sentiment to the market. In May, market players continued to report sluggish demand. However, there has been some uptick within the polyethylene and PET markets as we approach the summer, especially given the upcoming Olympic Games in Paris. Some participants also noted greater demand from the construction industry.

In the US, borrowing costs remain elevated, thus maintaining pressure on the plastics supply chain and negatively impacting demand. Due to persistently high inflation, market sources expect one or two 25 basis point cuts in 2024, at the very most. In the Eurozone, players anticipate the European Central Bank (ECB) will cut rates by 25 basis points in June, potentially easing financial pressures in that region.

The current demand dynamic in the plastics market means several producers have undergone maintenance, thus lowering supply. Furthermore, due to the weather, many plants in the US have declared force majeures, limiting output.

In terms of production costs, the price of the major raw materials for plastics production have started to stabilise. Additionally, the price of Brent crude oil fell in May as market players’ concerns about the conflict in the Middle East faded to a certain extent. US crude oil production is also forecast to hit record-high levels, reducing any supply concerns in the market.

Weak demand and oversupply led to steel price declines in May

Steel prices in May fell month-on-month (m-o-m) in the EU and US, but the decline seems to have stopped as prices were relatively stable during the month. The EU hot-rolled coil (HRC) price declined by 2% m-o-m to €636/MT in May and fluctuated slightly during the month. The CME’s US steel HRC 3-month price fell by 1% m-o-m to $907/MT.

The global steel market faced an oversupply of steel, which led to production cuts. Global steel production in April fell by 5% y-o-y, declining in all regional markets except the EU. Germany played a key role in production growth, where steel production rose by 6% y-o-y in April. However, German producers are still pessimistic about further production growth prospects, as they do not see demand growth, especially in construction.

Excess supply, especially on the import side, is putting significant pressure on the US market. As a result, the market is still in surplus despite the increase in consumption. The recovery of demand and high prices in the US market stimulated the growth of imports. Thus, there was an accumulation of imports, which provoked an oversupply on the market, which is felt in April and May. According to preliminary data, 2.5 million tonnes of steel were imported into the US in April, up 18% y-o-y. The growth was driven by imports of flat steel and imports of semi-finished products, which were up 47% and 62% y-o-y, respectively.

Benchmark raw material prices in China in May showed an increase, but market sources were sceptical as steel demand remains weak and steel producers are likely to pressure ore suppliers to lower prices. Prices for imported iron ore in China in May rose by 10% m-o-m; сoke prices rose by 6% m-o-m. As a result, the rise in raw material prices primarily helped to halt the further decline in steel prices rather than reverse the upward trend.

Unrest in New Caledonia ends, further nickel supply to be recovered

Nickel 3-month price on the LME continued to grow in May rose by 7% month-on-month, however, at the end of the month, experienced a downward correction. So in the last 10 days of May the price has fallen by 7%. One of the main factors supporting investors’ optimism in April – May was the decrease in the supply of nickel raw materials and nickel products amid the unrest in New Caledonia. The country is primarily the world’s second largest supplier of nickel raw materials.

However, at the end of May the protesters were actively suppressed and the riots were stopped in early June. Market sources now believe that nickel production and exports will be restored as soon as possible. However, the riots damaged some of the equipment, so it is unlikely that companies operating in the country will be able to quickly restore production to its previous level.

New Caledonia’s weight in the global nickel market is high, as the country supplies 14% of all nickel ore and concentrate, which is mainly exported to China. The country’s problems started at the beginning of the year and were reflected in a drop in production. Eramet reported